Difference Between Commercial Invoice and Invoice

Paperwork mix-ups in logistics can be expensive. One common mistake is using the wrong type of invoice – especially when shipping internationally. Standard invoices work fine for domestic transactions, but cross-border shipments need commercial invoices with extra details that customs requires.

Getting this wrong means delayed shipments, extra fees, and frustrated customers. The good news is that once you know the differences, it’s pretty straightforward. Let’s look at what sets these invoices apart and when to use each one.

What is a Standard Invoice?

A standard invoice is a basic billing document used for domestic transactions between businesses and customers. It serves as a formal request for payment and provides essential information about the goods or services provided. Most businesses use standard invoices for day-to-day operations, whether selling products locally or providing services within their home country.

The primary purpose of a standard invoice is straightforward – to get paid. It creates a paper trail for accounting purposes and helps businesses track their receivables. Unlike specialized trade documents, standard invoices focus on the financial transaction rather than regulatory compliance.

Key components typically included in a standard invoice are:

- Business name and contact information

- Customer details and billing address

- Invoice number and date

- Description of products or services

- Quantity and unit prices

- Subtotal, taxes, and total amount due

- Payment terms and due date

- Payment methods accepted

Standard invoices work well for domestic shipping scenarios where customs clearance isn’t required.

What is a Commercial Invoice?

A commercial invoice is what you need when shipping internationally – it’s basically a supercharged version of a regular invoice that customs officials actually care about. While regular invoices just handle the money side of things, commercial invoices have to satisfy government requirements for crossing borders.

Think of it this way: customs doesn’t care how much you charge your customer, but they definitely care what’s in those boxes, where it came from, and how much it’s worth for tax purposes. That’s where commercial invoices come in.

Commercial invoice includes:

- All the usual business and customer details

- Super detailed product descriptions (not just “widgets”)

- Those HS codes that classify what you’re shipping

- Where each product was actually made

- Real values and currencies involved

- Shipping terms like FOB or CIF

- Weight, dimensions, packaging info

- Official declarations and signatures

The difference between a commercial invoice and invoice hits you hard when that container sits at the port. Regular invoices won’t cut it for international shipments – customs needs all that extra data to figure out duties and make sure everything’s legit.

Get the commercial invoice wrong and your shipment gets flagged for inspection. That means delays, extra fees, and angry customers asking where their goods are. The values have to be spot-on too, because that’s how customs calculate what you owe them.

Key Differences Between Commercial Invoice and Invoice

While both documents request payment, they serve very different purposes in the supply chain world.

A standard invoice handles straightforward billing between businesses, focusing on getting paid for goods or services. Commercial invoices, however, must satisfy international trade regulations while also handling the billing function.

This dual purpose makes commercial invoices more complex and strictly regulated.

| Aspect | Standard Invoice | Commercial Invoice |

| Primary Purpose | Billing and payment collection | Customs clearance + billing |

| Usage | Domestic transactions | International shipments |

| Information Required | Basic product details | Detailed trade specifications |

| Regulatory Compliance | Minimal requirements | Strict customs regulations |

| Product Descriptions | General descriptions acceptable | Precise, detailed descriptions mandatory |

| Valuation | Flexible pricing presentation | Accurate declared values required |

| Format Requirements | Business decides format | Standardized elements required |

| Legal Consequences | Payment disputes only | Customs violations possible |

When to Use Each Document Type

The decision comes down to one simple factor: whether goods are crossing international borders.

For domestic shipments within the same country, standard invoices handle everything needed. Whether shipping from warehouse to retailer or directly to end customers, these basic billing documents provide sufficient documentation.

Domestic carriers and logistics providers accept standard invoices without question since no customs clearance is involved.

Standard invoice scenarios

- Local deliveries within your home country

- Domestic B2B transactions between suppliers and retailers

- Direct-to-consumer shipments staying within national borders

- Inter-state or inter-provincial shipping (within same country)

- Domestic freight and LTL shipments

International shipments require commercial invoices – no exceptions. The moment freight crosses a border, customs authorities need detailed trade information that only commercial invoices provide.

This applies whether shipping by air, sea, or ground transportation.

Commercial invoice scenarios

- Any shipment leaving your country of origin

- Imports coming into your country from abroad

- Free trade zone transactions crossing borders

- Temporary exports for trade shows or repairs

- Sample shipments to international prospects

The consequences of mixing up commercial invoice and invoice usage are immediate and costly. Using standard invoices for international shipments guarantees customs holds, inspection fees, and frustrated customers.

Conversely, commercial invoices aren’t necessary for domestic shipments and just create unnecessary paperwork complexity. Smart logistics teams establish clear procedures distinguishing when each document type applies, preventing expensive shipping mistakes.

Common Mistakes to Avoid

Even experienced logistics teams can stumble when handling the difference between commercial invoice and invoice requirements.

These mistakes often seem minor but can trigger major supply chain disruptions that cost time and money.

1. Using standard invoices for international shipment

Sending cross-border freight with basic invoices guarantees customs holds since officials need detailed trade information that only commercial invoices provide for proper clearance procedures.

2. Missing required commercial invoice elements

Forgetting essential details like HS codes, country of origin, or proper product descriptions causes customs delays even when using correct commercial invoice formats for international transactions.

3. Incorrect product valuations or classifications

Declaring wrong values or using inappropriate HS codes on commercial invoices triggers customs inspections and potential penalties, creating expensive delays throughout the entire supply chain network.

4. Treating all invoices the same

Failing to distinguish between commercial invoice and invoice requirements based on shipment destination leads to systematic documentation errors that compound over time across multiple shipments.

5. Inadequate staff training on documentation and automation

Teams that don’t understand when commercial invoices are mandatory versus when standard invoices suffice create inconsistent shipping practices that disrupt customer delivery schedules regularly.

A global pharmaceutical company reduced their invoice processing time by 65% and freed up 75% of their workforce by implementing automated invoice verification systems that eliminated manual documentation errors.

With that said, let’s now see some best practices to manage both types of invoices.

Best Practices to Commercial Invoice and Standard Invoice Management

These practices help logistics teams consistently choose between commercial invoice and invoice options, maintaining smooth operations across both domestic and international shipping channels.

1. Create clear documentation checklists

Develop separate checklists for domestic versus international shipments, specifying exactly when standard invoices work versus when commercial invoices are mandatory for customs clearance.

2. Train staff on document differences

Ensure warehouse and shipping teams understand the distinction between commercial invoice and invoice usage, including consequences of using wrong document types for different shipment destinations.

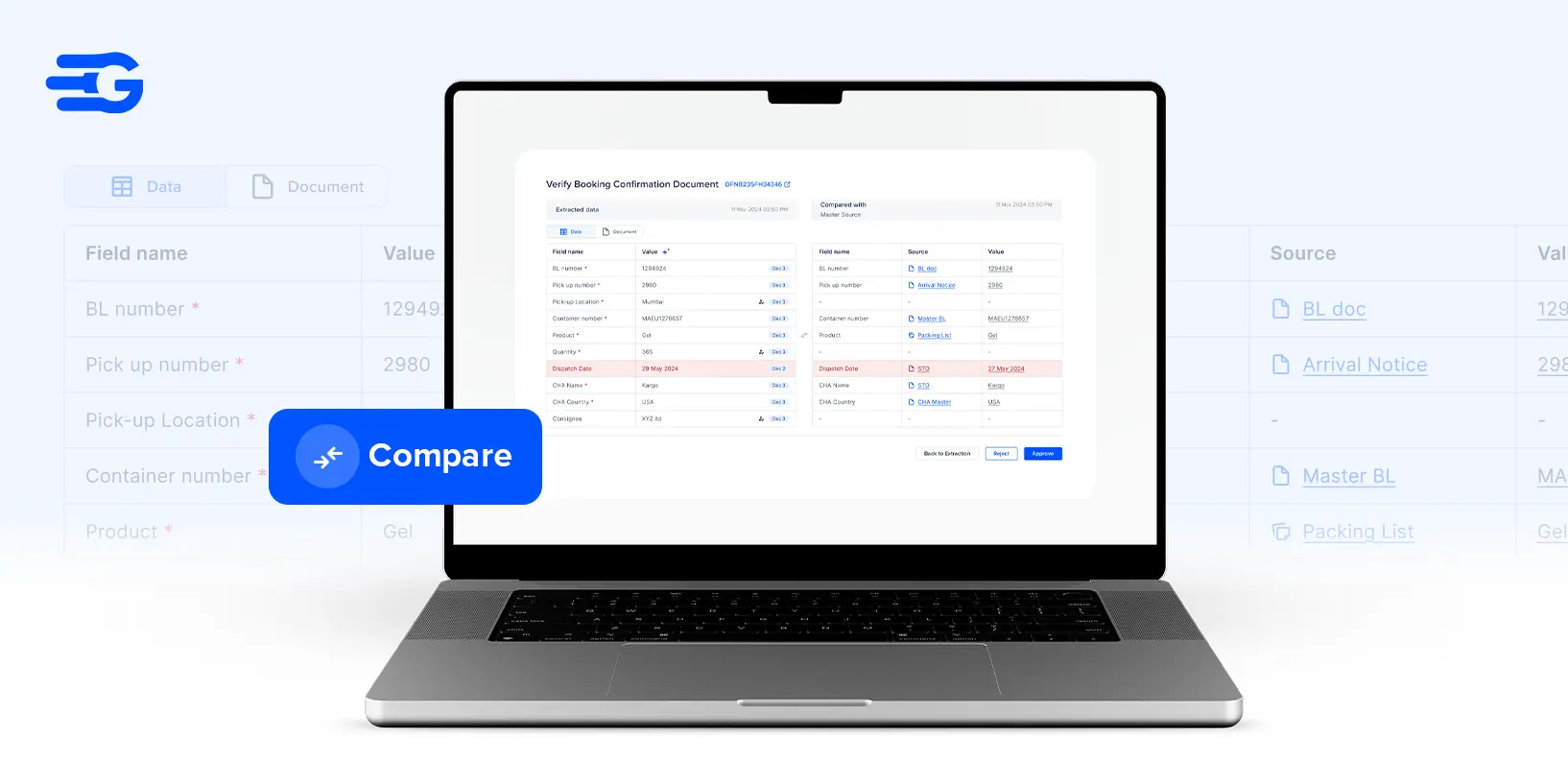

3. Implement automated decision systems

Use shipping software that automatically determines whether commercial invoices are required based on destination country, triggering proper documentation workflows without manual decision-making errors.

Research shows that systematic automation can boost processing capacity by nearly 400% compared to manual handling, making the investment in proper commercial invoice and invoice management systems worthwhile for high-volume operations.

4. Establish validation procedures

Create review processes where experienced team members verify that commercial invoices contain all required customs elements before shipments leave the facility, preventing border delays.

5. Maintain updated compliance resources

Keep current information about changing international trade requirements and ensure commercial invoice templates meet evolving customs regulations for different destination countries worldwide.

Conclusion

Proper documentation is just one piece of the logistics puzzle. Beyond getting invoices right, successful supply chain operations require visibility, carrier management, and cost optimization across all shipping channels.

The best logistics teams don’t just avoid documentation mistakes – they build systems that handle everything from rate shopping to delivery tracking seamlessly. That’s where real competitive advantages come from.

If you’re ready to move beyond basic documentation fixes and optimize your entire logistics operation, book a demo with GoComet.