What is Invoice Reconciliation? Before, After, and Future

Invoice reconciliation might sound straightforward, but for businesses handling numerous invoices, it’s often a logistical nightmare. Invoices can easily get lost in a pile of emails and spreadsheets, leading to missed deadlines, vendor frustrations, and inaccurate financial reporting.

But it doesn’t have to be this way. By automating the process, businesses can drastically cut down on errors and streamline the entire reconciliation process. Curious about how the traditional method stacks up? Let’s take a closer look at manual invoice reconciliation and why it’s time to rethink your approach.

Manual Invoice Reconciliation: The Traditional Way

Manual invoice reconciliation is exactly what it sounds like: matching invoices to purchase orders and delivery receipts, all by hand. The process involves digging through PDFs, emails, spreadsheets, and even printed documents to make sure everything lines up before a payment is made.

On paper, it seems simple enough, but in practice, it’s a labor-intensive process that takes up a lot of time and leaves room for mistakes.

In fact, as per PwC, 30% of a finance team’s time is spent on manual reconciliation, which is a huge chunk of their workload that could be better utilized elsewhere. Even more staggering, analysts in top-performing companies spend 40% of their time simply gathering data, rather than using that time for analysis or strategic decision-making.

1. The PDF and Spreadsheet Shuffle

Everything comes through in different formats in the manual process.

You’ve got purchase orders, invoices, and delivery receipts sitting in various places, maybe some are in emails, others in spreadsheets or physical files. Cross-referencing each of these documents to ensure everything matches is a slow, tedious process.

When everything’s scattered like that, it makes it harder to get a clear picture of what’s happening.

2. Time-Consuming and Prone to Errors

Going through all these documents manually takes time, and time pressure doesn’t help the accuracy of the work.

Small errors, like a missing zero on a line item or a misplaced date, can lead to bigger issues down the road. Since this process is so manual, the risk of human error increases. Mistakes may not be caught right away, but they can cause problems later, leading to late payments or inaccurate financial records.

3. Limited Tracking and No Audit Trail

One of the biggest limitations of manual invoice reconciliation is the lack of transparency. When you’re manually checking invoices and purchase orders, there’s no easy way to track where things are in the process or who is responsible for what.

If there’s a discrepancy, it can be hard to find out where the problem lies. You’re relying on your memory or on handwritten notes to keep track of any issues, and this makes it harder to maintain a clear audit trail for future reference.

4. Difficult to Scale

The more invoices and shipments your business handles, the harder it becomes to keep up with the manual process.

What worked when you had a small volume of transactions starts to break down when the volume increases. The process becomes slower, and your team will struggle to keep pace with the growing workload. As the business scales, the risk of mistakes grows, and it becomes harder to maintain the same level of accuracy and efficiency.

The Shift to Automation – Smarter, Faster Reconciliation

Manual invoice reconciliation has its limitations, but automation is changing the game.

With automated systems in place, businesses can speed up the entire process, reduce errors, and improve overall accuracy.

Instead of sifting through piles of documents and relying on human checks, automated tools can handle much of the heavy lifting, instantly matching invoices, purchase orders, and delivery receipts in real time.

1. Instant Document Matching

One of the main benefits of automation is that it can quickly match documents with minimal effort.

Automated tools instantly cross-check invoices against purchase orders and shipping records. If anything doesn’t match, the system flags it right away. This eliminates the need for manual cross-referencing and reduces the chances of human error.

You no longer have to spend hours checking each line item. Automation takes care of it in seconds.

2. Real-Time Alerts and Faster Resolutions

With automation, discrepancies are flagged instantly, and alerts are sent out to the right people. Whether it’s a mismatched rate or an overcharge, the system lets you know exactly where the problem lies. This makes resolving issues faster because the alerts guide your team to exactly what needs attention.

No more wasting time hunting down the source of an error. Everything is streamlined and easier to fix.

3. Centralized Dashboards for Full Visibility

One of the challenges of manual reconciliation is the lack of visibility. When you’re dealing with different systems and formats, it’s hard to keep track of everything. But with automation, everything is brought into a single, centralized dashboard.

You can monitor the entire reconciliation process from one place: seeing which invoices are still pending, which ones have been approved, and where discrepancies exist. This makes it easier to track progress and make decisions in real time.

4. Improved Accuracy and Compliance

Automation reduces the likelihood of errors that often happen in manual processes. By eliminating human intervention, automated systems ensure that everything matches up correctly, according to pre-set rules.

This also helps improve compliance since systems can be set up to follow specific guidelines and check against industry regulations. With better accuracy and fewer mistakes, businesses are less likely to face issues with missed payments or incorrect financial reporting.

5. Stronger Vendor Relationships

When you’re able to process invoices faster and more accurately, it improves your relationships with vendors. Timely payments and consistent communication build trust, which is crucial for any business.

Automation makes it easier to meet payment deadlines and keep vendors happy. And since discrepancies are handled quickly, there’s less friction in the process.

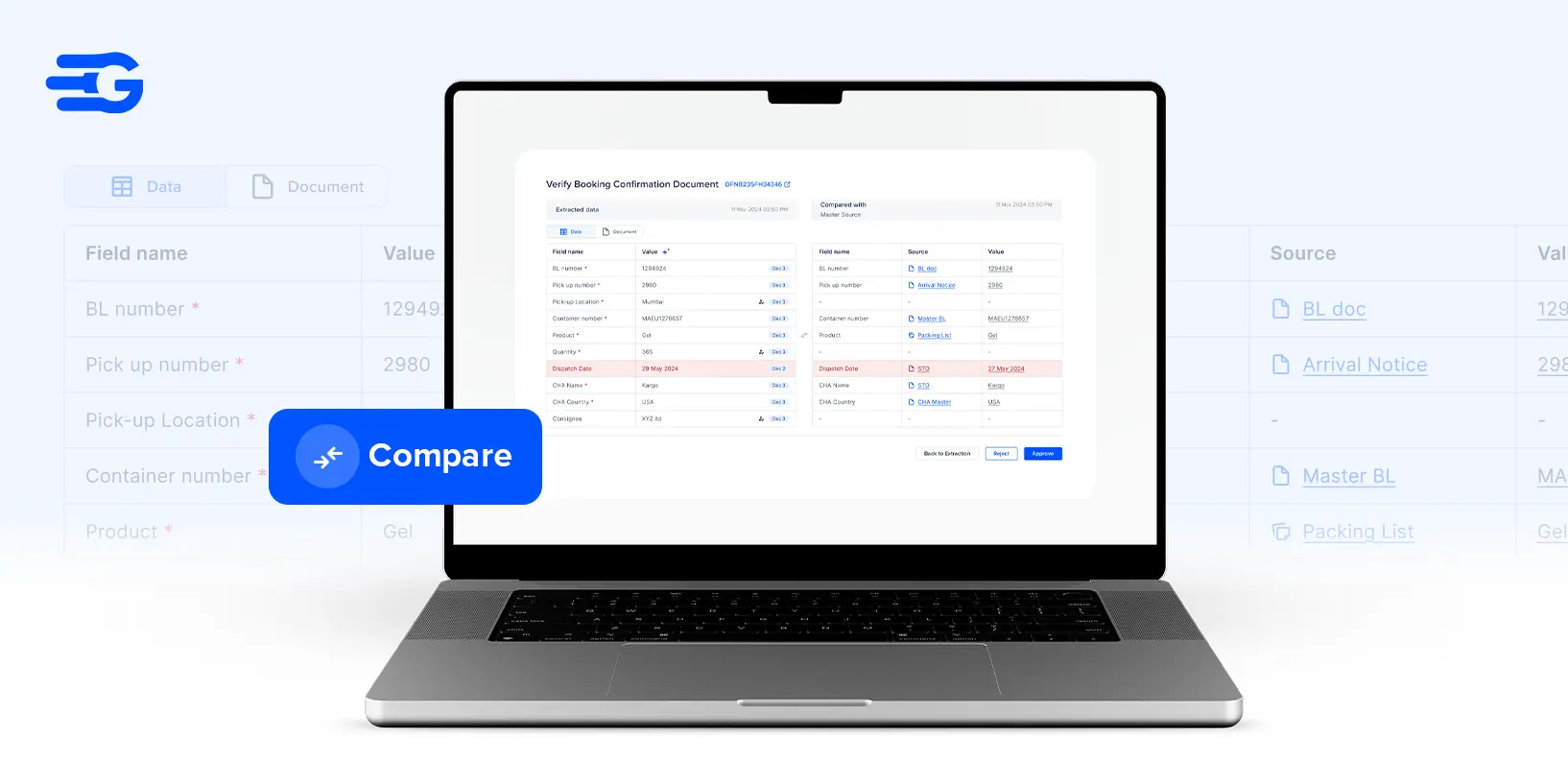

Where GoComet Comes In: GoInvoice

Freight invoice reconciliation is a critical yet often cumbersome process for businesses. Manually matching invoices to purchase orders, tracking discrepancies, and ensuring accuracy takes up valuable time and resources. GoComet’s GoInvoice automates the entire process, transforming how freight invoices are handled by making the workflow faster, more accurate, and far more efficient.

By using powerful technologies like Optical Character Recognition (OCR) and contextual language processing, GoInvoice automatically verifies invoices against the original quotations, catching discrepancies in real time. This not only reduces errors but also ensures that your payment processes are smooth and error-free.

Some key features of GoInvoice include:

- Automatic Invoice Matching: GoInvoice automatically matches freight invoices with the approved rates and shipment data, reducing manual work and ensuring accuracy.

- Real-Time Discrepancy Alerts: The system instantly notifies vendors of any discrepancies, ensuring quicker issue resolution and eliminating the need for constant follow-ups.

- Faster Payment Cycles: GoInvoice allows for auto-approvals based on predefined tolerance levels, speeding up the approval process and ensuring timely payments to vendors.

- Centralized Invoice Repository: All invoices, quotes, and payment statuses are stored in one place, making it easier to track progress and maintain records.

- Seamless Auditing: Time-stamped actions on each invoice create a clear audit trail, making the entire process more transparent and simplifying audits.

GoInvoice is a comprehensive tool that takes the complexity out of freight invoice reconciliation, helping businesses save time, reduce errors, and build stronger relationships with vendors.

For example, a global pharmaceutical company used GoInvoice to streamline their manual invoice verification. After implementing the solution, they reduced processing time by 65% and eliminated tedious manual follow-ups with vendors, allowing their team to focus on higher-value tasks.

Closing Thoughts

Invoice reconciliation doesn’t have to be a time-consuming, error-prone task. By automating the process with GoInvoice, businesses can save valuable time, reduce the risk of mistakes, and improve efficiency across their logistics and finance teams. With features like automatic invoice matching, real-time alerts, and centralized record-keeping, GoInvoice provides a smarter, faster way to manage freight invoices, ultimately helping businesses stay on top of their payments and vendor relationships.

If you’re ready to take your invoice reconciliation process to the next level, GoInvoice can help. Book a demo today to change the way you handle freight invoices.