Understanding Invoice Matching: Types, Processes, and Best Practices

Most logistics companies are drowning in paperwork. Bills from trucking companies don’t match the original quotes. Warehouse invoices have mystery charges nobody can explain. And somehow you’re always paying twice for the same fuel surcharge. Sound familiar?

The truth is, most business owners hate dealing with invoice matching because it’s boring and time-consuming. But ignore it and you’ll bleed money. But spending a little time upfront organizing this mess can save you thousands later. Let’s break down exactly how to set this up so you can stop throwing money away and get back to running your business.

What Is Invoice Matching?

Invoice matching is the process of comparing and verifying invoices against other business documents before making payments. This means checking that what you’re being billed for actually matches what you ordered and received.

Think of it as a checkpoint system. Before you pay that trucking company’s bill, you verify the freight charges match your original quote. Before paying warehouse fees, you confirm the services were actually provided.

It’s essentially making sure you’re not getting ripped off.

The process typically involves three key documents:

- Your purchase order (what you agreed to buy)

- The delivery receipt (proof you got it)

- The vendor’s invoice (what they’re charging you).

When these documents align, you can confidently process the payment.

Types of Invoice Matching

Invoice matching isn’t one-size-fits-all. Different situations call for different levels of verification.

There are mainly three ways companies typically handle it:

- Two-Way Matching

Two-way matching compares your purchase order against the vendor’s invoice. That’s it – just two documents. You’re checking that the price, quantity, and terms match what you originally agreed to.

This works well for simple transactions like monthly software subscriptions or standard service agreements. If you’ve got a fixed-rate contract with a carrier for regular routes, two-way invoice matching gets the job done quickly. You’re not dealing with variables like damaged goods or partial deliveries.

The downside? You’re taking the vendor’s word that they actually delivered what they’re billing for. For most logistics operations, this isn’t enough protection.

- Three-Way Matching

Three-way matching adds proof of delivery to the mix. Now you’re comparing the purchase order, the vendor’s invoice, and your delivery receipt or goods received note. This is the sweet spot.

When your freight carrier sends an invoice, you check it against your original shipping order and the delivery confirmation. Did they deliver to the right location? Was the freight in good condition? Did they add any surprise charges?

This method catches the most common problems in logistics – like paying for deliveries that never happened or services that weren’t performed correctly. It’s thorough without being overly complicated.

- Four-Way Matching

Four-way matching throws in an inspection document. You’re now verifying the purchase order, invoice, delivery receipt, and an inspection report that confirms everything arrived in acceptable condition.

This level of scrutiny makes sense for high-value shipments, specialized equipment, or when you’re dealing with vendors who’ve had quality issues. If you’re importing expensive machinery or handling pharmaceutical shipments, the extra verification step protects against costly mistakes.

The trade-off is speed. Four-way invoice matching takes longer and requires more documentation, so most companies reserve it for their biggest or riskiest transactions.

How Invoice Matching Works

Invoice matching isn’t just about checking if numbers match.

In logistics, you’re dealing with fuel surcharges that change weekly, accessorial charges that weren’t on the original quote, and delivery delays that might affect your rates. Here’s what actually happens:

Below is how a normal manual process works. However, fret not! We are going to cover how to automate invoice matching right after this section.

Step 1: Pull your original shipping quote and compare line by line against the carrier’s invoice

Check base freight rates, fuel surcharges (these change constantly), detention fees, and any accessorials like liftgate service or inside delivery. Flag anything that wasn’t on your original rate confirmation.

Step 2: Cross-reference delivery proof with what you’re being charged for

Match the bill of lading number, pickup and delivery dates, and actual weight against the invoice. Carriers sometimes bill for services they didn’t provide or use estimated weights that are way off from actual.

Step 3: Verify accessorial charges against your delivery receipts and any photos

Did they really need that liftgate? Was there actually a detention charge because your dock was busy? These add-on fees are where most overcharges happen.

Step 4: Check payment terms and any negotiated discounts

Confirm you’re getting your volume discounts, early payment discounts, or any special rates you negotiated. Also verify the payment terms match your contract (net 30 vs net 15).

Step 5: Route mismatched invoices back to the carrier with specific questions

Don’t just reject the invoice. Tell them exactly what’s wrong: “Your invoice shows $150 detention but our delivery receipt shows driver arrived at 2 PM and was unloaded by 2:30 PM.”

This level of detail matters because freight invoices are notorious for errors. Skip the thorough check and you’ll pay for services you never received. But when invoice verification takes too long, 40% of AP teams end up paying suppliers late. This creates a balancing act between thoroughness and speed – which is why many companies are turning to automated solutions.

GoComet for Invoice Matching

Invoice matching with spreadsheets and manual checks works until you’re processing hundreds of invoices monthly and spending more time on paperwork than actual logistics.

Technology can handle the heavy lifting here.

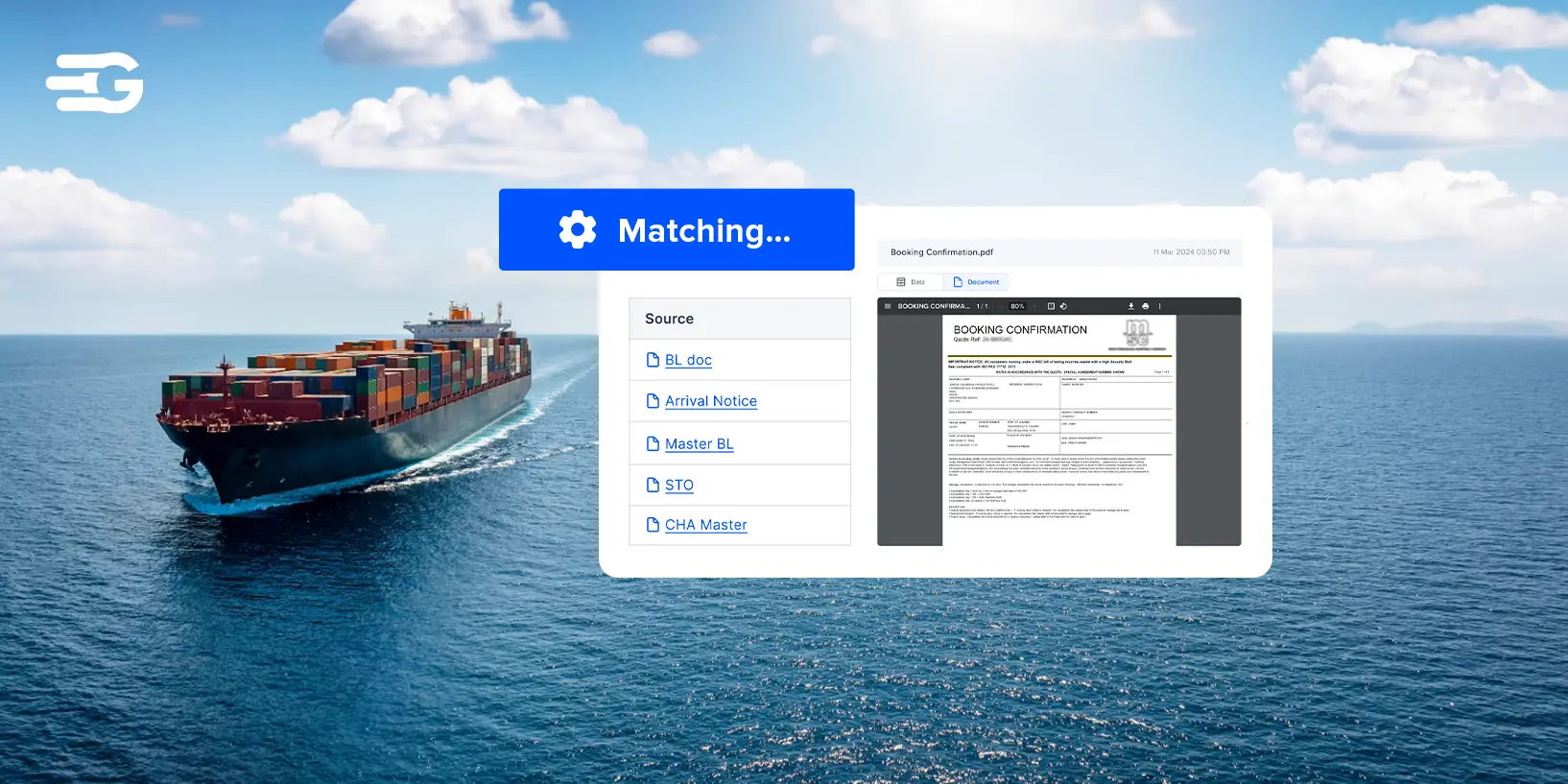

GoComet’s freight invoice reconciliation system tackles the specific problems.

Instead of generic accounting software, it’s built around how freight billing actually works – with all the complexities of accessorial charges, fuel surcharges, and carrier-specific billing practices.

GoComet’s system…

- Reads freight invoices automatically using their iOCR technology – No more manually typing invoice data into spreadsheets. The system pulls rates, charges, and reference numbers directly from PDF invoices.

- Compares every invoice against your original rate quotes – Spots differences between what you were quoted and what you’re being billed, including fuel surcharge calculations and unexpected accessorial charges.

- Sends automatic dispute notifications to carriers – When discrepancies are found, the system emails carriers with specific details about the problem instead of you having to call or email manually.

- Lets you set tolerance levels for auto-approval – Minor differences (like a few dollars in fuel surcharges) can be automatically approved while larger discrepancies get flagged for review.

- Integrates with your existing accounting system – Once invoices are verified and approved, payments can be initiated automatically without re-entering data.

The real benefit is catching billing errors that slip through manual processes. When you’re dealing with multiple carriers and complex rate structures, automated matching finds money you didn’t know you were losing.

Final Thoughts

Once you’ve got a solid process in place, you can start tracking which carriers consistently bill accurately and which ones need closer watching. This data helps with vendor negotiations and contract renewals.

The next step is deciding whether to keep doing this manually or invest in automation. If you’re processing more than 50 invoices monthly, the math usually favors technology. Your team stops chasing paperwork and starts focusing on strategic work that actually grows the business.

Stop leaving money on the table with manual invoice processes. See how GoComet’s automation works for your business.