Essential Guide to Shipping to UK from USA: Procedures, Costs, and Tips

In today’s interconnected world, the trade relationship between the United States and the United Kingdom stands as a testament to the strength of international commerce. In 2023, the United States engaged in significant foreign trade with the United Kingdom, demonstrating a substantial economic relationship. The trade balance between the two nations showed a consistent surplus for the United States, totaling $8.26 billion. Throughout the year, both countries saw robust exchange in goods, with the U.S. exporting a total of $66.92 billion and importing $58.66 billion worth of goods from the United Kingdom. This consistent trade flow underscores the strong economic ties, with the U.S. consistently exporting more to the UK than it imported, resulting in a positive trade balance along the container ports.

Exploring Shipping Options from the USA to the UK

When it comes to shipping goods from the USA to the UK, businesses have many options to consider. Two primary methods include air freight and sea freight. However, let’s try to answer the age-old question, air freight vs sea freight.

Comparison

- Air Freight:

Air freight is renowned for its speed and reliability, making it an attractive option for businesses with time-sensitive shipments or high-value goods. With air freight, goods can reach their destination in a matter of days, compared to the weeks it may take via sea freight. This rapid transit time ensures that perishable items stay fresh and that urgent orders are delivered promptly.

However, the speed of air freight comes at a premium cost. Shipping via air is generally more expensive than sea freight, especially for larger or heavier shipments. Businesses must weigh the benefits of speed against the higher transportation costs to determine if air freight is the right choice for their specific needs.

Another factor to consider with air freight is cargo capacity. While airlines offer extensive networks and frequent flights between the USA and the UK, cargo space can be limited, particularly during peak seasons or times of high demand. Businesses shipping large volumes may need to book space well in advance to secure their shipment’s spot on the aircraft.

- Sea Freight:

Sea freight provides a cost-effective solution for shipping goods in bulk or those that are not time-sensitive. While sea freight may have longer transit times compared to air freight, it offers significant savings, particularly for large or heavy shipments. Businesses shipping goods with a lower value or those that can withstand longer transit times often opt for sea freight to minimize transportation expenses.

Sea freight also offers flexibility in terms of cargo size and type. Shipping containers come in various sizes, allowing businesses to choose the container type that best suits their shipment’s requirements. Additionally, sea freight can accommodate oversized or irregularly shaped cargo that may not fit within the confines of an aircraft’s cargo hold.

Despite its cost-effectiveness, sea freight does have some limitations. Longer transit times mean that businesses need to plan ahead to ensure timely delivery of goods. Additionally, sea freight may involve more complex logistics, including coordinating transportation to and from ports and navigating customs procedures.

Choosing the Right Shipping Carrier:

Once businesses have decided on the preferred shipping method, the next step is to select the right shipping carrier. Major carriers like FedEx, UPS, and DHL offer comprehensive international shipping services, including both air and sea freight options.

When choosing a shipping carrier, businesses should consider factors such as cost, reliability, and additional services. It’s essential to compare shipping rates and transit times to find the carrier that offers the best value for money. Additionally, businesses should assess the carrier’s track record for on-time delivery and customer satisfaction to ensure a smooth shipping experience.

Navigating Customs and Duties for UK Shipments

Understanding the nuances between duties, taxes, and tariffs is vital in crafting an effective international shipping strategy. Customs duties, set by governments, regulate imports to protect domestic industries. These duties, negotiable and typically ranging from 0% to 30-40%, undergo slow changes driven by international trade negotiations. In contrast, tariffs are specific fees imposed on certain goods at distinct times, subject to governmental discretion. Import taxes, like VAT or GST, add extra costs and vary across countries. Accurate product declaration and origin certification are crucial to avoid penalties. Incoterms delineate buyer and seller responsibilities, influencing logistics and cost allocation. Integrating these fees into shipping strategies can occur through methods such as total landed cost solutions or customer-paid duties.

Understanding UK Customs Regulations

When shipping goods to the UK, it’s crucial to understand the customs regulations to ensure a smooth process. Here’s what you need to know:

1. Required Paperwork:

- Commercial Invoice: This document details the transaction between the exporter and importer, including information such as names and addresses, invoice number, description of goods, quantity, value, and payment terms. It’s essential for customs clearance.

- Customer Declaration: Required for goods valued over EUR 20,000, this document helps assess the value of the transaction for tariff duties.

- Proof of Origin: Certifies the country of origin of the goods, which can be proven through certificates of non-preferential or preferential origin, invoice declarations, or certificates of binding tariff information.

- Transport Documents: Depending on the mode of transport, various documents such as Bill of Lading, Air Waybill, or Road Waybill are required.

- Packing List: Provides details of the items being imported, including packaging information and dimensions.

2. Customs Procedures:

- Goods entering the UK must be declared to customs using the Single Administrative Document (SAD), which includes information about the parties involved, goods, transport, and financial details.

- Customs procedures include a release for free circulation, special treatments like transit or storage, specific use such as temporary admission or end-use, and processing for inward or outward processing.

3. Economic Operator Registration and Identification (EORI) Number:

- All economic operators, including companies and individuals, must register for an EORI number assigned by a customs authority in an EU country.

- The EORI number is used in all communications with EU customs authorities and is required for customs declarations.

Calculating Duties and Taxes

Estimating duties and taxes for shipments to the UK involves several factors. Here’s what you need to consider:

1. Tariff Duties: Tariff duties are based on the customs value of the goods and the applicable tariff rates. The customs value includes the value of the goods plus any additional costs such as transportation and insurance.

2. Value Added Tax (VAT): VAT is applied to the customs value of the goods plus any applicable duty. The standard VAT rate in the UK is 20%, but certain goods may qualify for reduced rates or exemptions.

3. Excise Duties: Excise duties may apply to specific goods such as alcohol, tobacco, and fuel. The rates vary depending on the type and quantity of the goods.

4. Duty Exemptions: Certain goods may qualify for duty exemptions or reduced rates based on their nature, intended use, or origin. It’s essential to check if your goods meet any eligibility criteria for exemptions.

By understanding UK customs regulations and calculating duties and taxes accurately, businesses can ensure compliance and facilitate seamless shipments to the UK.

Calculating Duties and Taxes

Understanding how duties and taxes are calculated for shipments to the UK is crucial for smooth freight management. Several factors come into play when determining these fees. Firstly, the HS code, which categorizes the product, is used by customs to assess applicable taxes and duties. Accurate declaration of the goods’ value on the commercial invoice is essential, as it helps customs calculate the fees accurately.

Additionally, details such as the goods description and country of manufacture aid in proper classification. International trade agreements can influence the amount of taxes and duties, with exemptions or reduced rates applying to certain shipments. To calculate import duties, one must determine the duty percentage rate specific to the destination country and multiply it by the total value of the goods.

For example, if the duty percentage rate on a shipment entering the UK is 12%, and the total value of the goods, including freight costs, insurance, and any additional costs, is £1,000, then the duty payable would be £120 (12% of £1,000). Similarly, the VAT rate of the destination country is applied to the total value of the shipment to calculate taxes. For instance, if the VAT rate in the UK is 20% and the total value of the shipment is £1,000, then the VAT payable would be £200 (20% of £1,000).

These fees are typically paid before the goods are released from customs, and additional costs such as courier fees, broker fees, and insurance should also be considered for a comprehensive understanding of the shipment’s total costs.

Packaging and Labeling Requirements

Packaging and labelling requirements in the UK have evolved since the country departed from the EU in 2021. These changes, aligning EU regulations with UK law, include amendments tailored for the UK and Great Britain. Notably, Natasha’s Law, spurred by a tragic incident, focuses on allergen labelling.

Measures like the plastic packaging tax, effective April 2022, address single-use packaging concerns. British consumers are adapting to new labelling practices, emphasizing food names, expiration dates, warnings, net quantity, country of origin, and storage instructions. Starting October 2022, food labels in Great Britain must include a UK address for the food business or importer. Certain food categories require additional labelling for biotechnology, organic products, and allergens.

Environmental messaging and recyclability labeling, while voluntary, are increasingly common. The UK government plans consultations on labeling issues like livestock production, packaging recyclability, and health metrics, with changes undergoing a gradual transition period to accommodate businesses. Compliance with evolving labeling standards remains crucial for US exporters accessing the UK market.

Cost-Effective Shipping Strategies to the UK

Strategies to minimize shipping costs without compromising on service quality, including bulk shipping and carrier negotiations. Shipping can be tricky and can be optimized by supply chain management tools. Sometimes packages get lost or products arrive damaged. But don’t worry, there are solutions to these common problems. As a business owner, it’s important to make sure your products reach your customers safely and on time. Here are seven strategies to help you overcome the most common shipping challenges:

- Bulk Shipping: If you ship a lot of products, consider bulk shipping. This can help you save money on shipping costs by combining multiple orders into one shipment. Look for carriers that offer discounts for bulk shipping.

- Carrier Negotiations: Talk to your shipping carrier about negotiating better rates. Many carriers are willing to work with businesses to find a shipping solution that fits their budget. You can also explore different shipping options to find the best deal for your business.

- Shopify Shipping Discounts: If you use Shopify, take advantage of their shipping discounts. You can save up to 50% on shipping labels through USPS. This can help you save money on shipping costs and keep your margins high.

- Flat Rate Shipping: Consider using flat rate shipping for certain products. This can help you save money on shipping costs, especially if you frequently ship to the same locations. Many carriers offer flat rate shipping options based on package size and destination.

- Shipping Insurance: Invest in shipping insurance to protect your business from lost or damaged shipments. While it may cost a little extra upfront, shipping insurance can save you money in the long run by covering the cost of lost or damaged items.

- Communication with Suppliers: Keep the lines of communication open with your suppliers. If you’re experiencing inventory issues or delays, let them know as soon as possible. They may be able to offer solutions or expedite your order to help you avoid backorders.

- Customer Notifications: Keep your customers informed about their orders. If a product is out of stock or delayed, send them a notification so they know what to expect. This can help manage their expectations and prevent disappointment.

Besides, the latest logistic management tools and software can help in selecting the most efficient shipping carriers.

Managing Shipping Delays and Challenges

Dealing with shipping delays and challenges requires proactive measures:

- Global Emergencies

Stay informed about global emergencies such as pandemics, wars, or natural disasters that can disrupt supply chains. Develop contingency plans and maintain open communication with customers to mitigate the impact of emergencies on shipping operations.

- Supply Chain Disruption

Monitor supply chain trends and proactively address any disruptions such as shortages, port congestion, or freight capacity restrictions. Diversify suppliers and optimize inventory management to minimize the impact of supply chain disruptions on shipping operations.

- Weather Anomalies

Monitor weather forecasts and plan shipments accordingly to minimize the impact of weather-related disruptions. Communicate with customers about potential delays and have contingency plans in place to ensure timely delivery of goods.

- National and International Holidays

Plan ahead for carrier closures during holidays to avoid shipping delays. Adjust shipping schedules and manage inventory levels to accommodate holiday closures and ensure uninterrupted shipping operations.

Labor Issues

Stay informed about labor trends and address any workforce shortages, strikes, or outbreaks that may affect shipping operations. Maintain open communication with carriers and have backup plans in place to mitigate the impact of labour-related issues on shipping operations.

Legal and Prohibited Items in UK Shipments

Prohibited Items

Certain items are strictly forbidden from being shipped to the UK, including explosives, firearms, and hazardous materials. Postal services and couriers prohibit these items from complying with national and international regulations and ensure safety during handling.

Common Prohibited and Restricted Items

- Aerosols for Toiletry or Medicinal Purposes

- Alcohol (24% to 70% ABV)

- Alcohol (Under 24% ABV)

- Batteries (Various Types)

- Biological Substances

- Electronic Devices with Lithium Batteries

- Environmentally Hazardous Substances

- Guns for Sporting Use

- Human or Animal Ashes

- Human or Animal Samples

- Liquids over 1 Litre

- Liquids under 1 Litre

- Live Creatures, Insects, and Invertebrates

- Nail Varnish, Polish, or Gel

- Perfumes and Aftershaves

- Perishables

- Aerosols (Other)

- Alcoholic Beverages (70% ABV)

- Ammunition

- Used and Dangerous Batteries

- Unconnected Lithium Batteries

- Clinical and Medical Waste

- Controlled Drugs and Narcotics

- Corrosives

- Environmental Waste

- Explosives

- Flammable Liquids

- Flammable Solids

- Gases

- Balance Boards

- Infectious Substances and Pathogens

- Lighters containing Flammable Liquid or Gas

- Magnetised Materials

- Matches

- Oxidizing Materials or Organic Peroxides

- Pesticides

Restricted Items

Restricted items may be allowed under specific circumstances but require permits or licenses for importation. Examples include controlled substances, endangered species, and hazardous materials. Businesses must obtain the necessary permits or licenses and adhere to any restrictions or conditions imposed by postal services or couriers when shipping restricted items to the UK.

By following these guidelines and strategies, businesses can navigate the shipping process from the USA to the UK effectively, ensuring the timely delivery of goods while complying with all relevant regulations and requirements. Whether shipping by air or sea, understanding customs procedures, and adopting cost-effective strategies, businesses can optimize their supply chain and facilitate seamless shipments to the UK market.

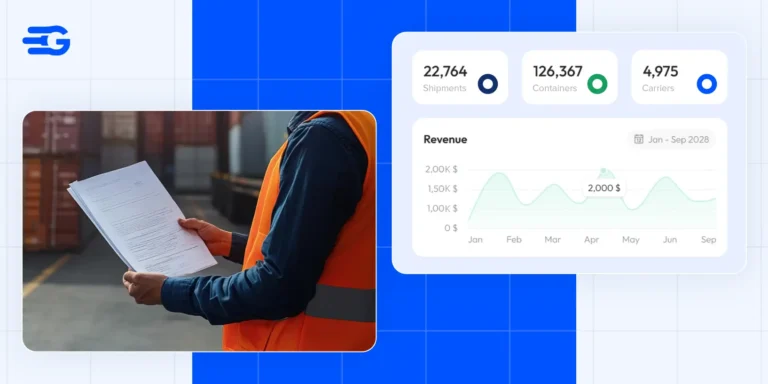

In conclusion, navigating the shipping process from the USA to the UK demands careful consideration of various factors, including shipping methods, customs regulations, and cost-effective strategies. To streamline this complex process and ensure seamless shipments, businesses can leverage GoComet’s software solutions. From comprehensive freight management tools to real-time tracking and compliance management, GoComet offers the necessary tools to optimize supply chains and facilitate hassle-free shipping to the UK market. Take the next step towards efficient shipping operations with GoComet’s innovative software solutions. Streamline your shipping process today and unlock new possibilities for international trade.