Shipping Costs from the US to Southeast Asia [2025 Guide]

With $476.8 billion worth of trade flowing between the US and ASEAN countries in 2024, these rate swings are reshaping how companies think about their supply chains and sourcing strategies.

The shipping cost from USA to Southeast Asia used to follow predictable seasonal patterns. Peak season meant higher rates, Chinese New Year brought brief dips, and you could budget accordingly. Not anymore.

Between Trump slapping 46% tariffs on Vietnam and 37% on Thailand, carriers pulling capacity off routes, and bunker fuel adjustments hitting every quarter, your freight spend has likely turned into a guessing game.

Time to understand what’s actually moving these numbers so you can plan smarter.

Breakdown of Shipping Costs

The final rate is built from several moving pieces, and each one can swing your total cost by hundreds or even thousands of dollars.

Let’s break down what you’re actually paying for when you move containers across the Pacific.

Base Freight Rates

The base freight rate is your foundation cost. The carrier’s charge to move your container from a US port to Southeast Asia. For FCL shipments, this is a flat fee regardless of whether your 40-foot container is packed to the ceiling or half empty. Current base rates are running around $2,300 to $3,500 per FEU depending on your route and timing.

For LCL, since you’re sharing container space with other shippers, you pay per cubic meter (CBM). Rates typically range from $120 to $280 per CBM on major routes to Singapore, Thailand, or Vietnam.

The break-even point where FCL becomes cheaper than LCL usually hits around 15 CBM. That’s when smart shippers start looking at full containers even if they don’t need all the space.

Port Charges

Port charges are where shipping cost from USA to Southeast Asia gets complicated fast. Every time your container touches a terminal, someone’s getting paid.

- Origin charges at US ports like Los Angeles or Long Beach can run $400-$800 per container.

- Destination charges in Southeast Asia vary wildly. Singapore might hit you for $300, while smaller ports in Vietnam or Thailand could charge $150-$500 depending on handling requirements.

- Terminal Handling Charges (THC) are separate fees that ports charge for moving your container between the ship and the terminal.

These aren’t negotiable and they’re not going away.

Budget around $200-$400 per container on each end of your shipment.

Fuel and Bunker Surcharges

The Bunker Adjustment Factor (BAF) is where fuel price volatility hits your freight bill. Carriers adjust these surcharges quarterly based on marine fuel costs, and they can swing your shipping cost from USA to Southeast Asia by $200-$600 per container. When oil prices spike, your BAF goes up. When they drop, you get a break. The problem is predicting which way they’ll move three months out.

Documentation and Insurance

Documentation fees cover your Bill of Lading, customs paperwork, and other required shipping documents. Budget $75-$150 per shipment. Marine cargo insurance typically runs 0.1% to 0.3% of your cargo value. So $100-$300 for a $100,000 shipment.

Security fees have become standard since 9/11. The International Ship and Port Facility Security (ISPS) surcharge runs $15-$25 per container. Some carriers also add Container Security Initiative (CSI) fees for shipments entering certain US ports.

Total Costs (estimates)

For a typical 40-foot container moving from Los Angeles to Ho Chi Minh City, here’s what your shipping cost from USA to Southeast Asia might look like:

- Base freight: $2,800

- Origin charges: $650

- Destination charges: $420

- BAF: $380

- Documentation: $125

- Security fees: $20

- Total: $4,395

That same shipment to Singapore might run $4,650, while routing to Jakarta could drop to $4,100. The differences come down to port efficiency, handling costs, and local surcharges that vary by country.

Understanding these components helps you spot where costs are actually moving and where you might have room to negotiate.

When carriers start talking about “all-in” rates, make sure you know which pieces are included and which ones will show up as surprises later.

Impact of Global Volatility

Trump’s April 2025 tariff announcements hit Southeast Asian countries harder than most expected, fundamentally changing how businesses calculate their total landed costs.

- Southeast Asian Tariff Impact: Vietnam faces 46% tariffs, Thailand 37%, and Cambodia 49%, compared to the EU’s 20% rate. These tariff levels have forced major container shipping companies to suspend weekly routes as trade volumes dropped significantly.

- Supply Chain Rerouting: Companies are moving production between Southeast Asian countries to optimize tariff exposure. This creates uneven demand across regional ports, with some seeing congestion while others lose volume, directly affecting shipping cost from USA to Southeast Asia based on origin country.

- Planning Uncertainty: Long-term freight contracts have largely disappeared, replaced by short-term spot pricing. Carriers now adjust capacity weekly rather than seasonally, making it nearly impossible to budget shipping cost from USA to Southeast Asia more than 30 days in advance.

- Freight Volume Decline: Ocean container bookings from Asia to the US fell 60% after the tariff announcement. Carriers responded by cancelling 25% of sailings and removing substantial capacity from the market, making shipping cost from USA to Southeast Asia increasingly unpredictable.

These geopolitical shifts have transformed freight procurement from a predictable operational expense into a strategic decision requiring constant market monitoring.

Companies that previously locked in annual shipping contracts now find themselves managing freight costs in real-time, with rate changes potentially impacting product pricing and sourcing decisions on a monthly basis.

Tips to Reduce US-Southeast Asia Freight Costs

Managing shipping cost from USA to Southeast Asia requires strategic thinking beyond just comparing quotes. Here are some approaches you can use to cut costs while maintaining service reliability.

| Strategy | How It Reduces Costs | Implementation |

| Optimize Container Utilization | Avoid paying for empty space in FCL shipments or unnecessary LCL markups | Calculate break-even point around 15 CBM. If shipping 12-18 CBM, compare FCL vs LCL rates including all surcharges |

| Leverage Port Alternatives | Secondary ports often charge 20-30% lower handling fees than major hubs | Consider Oakland vs Los Angeles for US origin, or Port Klang vs Singapore for Southeast Asia destinations |

| Use Technology Platforms | Automated benchmarking and competitive bidding drive down rates | Implement platforms like GoComet for real-time rate comparison and vendor competition. Track performance metrics to optimize carrier relationships |

There’s one great example as well: Mega WeCare, a global pharmaceutical company with operations across 31 countries, faced similar freight cost challenges when managing shipments.

By implementing GoComet, they achieved an 11% savings on confirmed shipments and expanded their vendor pool by 180%, enabling more competitive bidding for their international routes.

Before we end the blog, here’s exactly how GoComet can help.

GoComet’s Role in Cost Optimization

When shipping cost from USA to Southeast Asia changes weekly instead of seasonally, traditional freight management approaches fall apart.

GoComet’s AI-powered platform addresses this new reality by giving companies the tools to navigate constant rate volatility and make smarter procurement decisions.

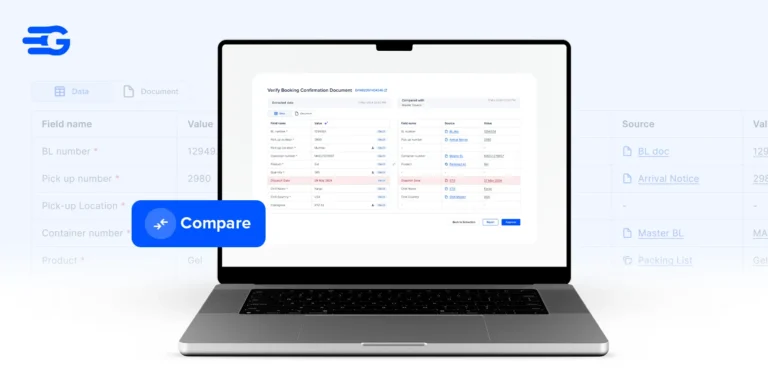

- Real-Time Rate Benchmarking: GoComet’s platform analyzes over 25,000 freight quotes monthly from 4,000+ vendors worldwide, providing instant market comparisons for shipping cost from USA to Southeast Asia. Instead of calling multiple forwarders for quotes, companies get transparent rate data that shows whether they’re paying above or below market rates on any given route.

- Automated Freight Procurement: The platform’s reverse auction system lets vendors compete automatically for your business, driving down costs through competitive bidding.

- Predictive Analytics for Planning: GoComet’s AI analyzes historical patterns, seasonal trends, and market disruptions to forecast rate movements. When tariffs or capacity changes are likely to impact shipping cost from USA to Southeast Asia, the platform provides early warnings so companies can adjust procurement timing or explore alternative routes.

- Port Congestion Intelligence: The platform tracks vessel delays and port congestion in real-time across Southeast Asian destinations. This visibility helps companies anticipate delays and factor potential demurrage costs into their shipping cost from USA to Southeast Asia calculations before problems arise.

GoComet changes freight management from reactive firefighting into proactive strategy.

Companies gain the visibility and automation needed to maintain control over their logistics spend even when global trade conditions create daily volatility in shipping markets.

Conclusion

Nobody’s getting a crystal ball for freight rates anytime soon. The shipping cost from USA to Southeast Asia is going to keep bouncing around as long as trade policies change every few months and carriers play capacity games. Your best bet is treating freight procurement like any other strategic spend category instead of just calling the same forwarder every time.

If you are ready to take control of your freight costs, book a demo with GoComet to see how our AI-powered platform can optimize your shipping spend across Southeast Asian routes.

![Shipping Costs from the US to Southeast Asia [2025 Guide] 1 Shipping Costs from the US to Southeast Asia](https://www.gocomet.com/blog/wp-content/uploads/2025/06/Shipping-Costs-from-the-US-to-Southeast-Asia.webp)